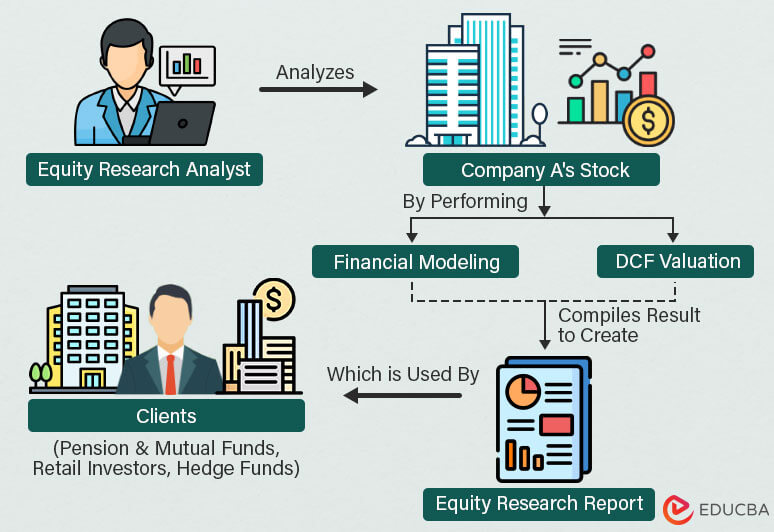

An equity research report is a document that includes information about company stock, such as its target share price, recommendation (whether to buy, hold, or sell), key statistics, and graphs to help investors make investment decisions. Financial analysts or equity research analysts working for either sell-side or buy-side firms write equity research report.

Clients for these reports generally include retail brokers, pension and mutual fund houses, wealth management firms, individual clients, and hedge funds.

These reports include detailed company financial performance analysis, industry outlook, competitive landscape, and market trends. Therefore, they serve as valuable resources for both experienced investors and those new to the financial markets.

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Here’s a detailed format you can follow to write equity research report:

1. Company Name and Logo

This is the first thing you will see at the top of the report. It includes the name and logo of the company.

2. Date of the Report

The issue date of the report is important for reference, as market conditions and company performance can change over time.

3. Report Title

A concise and informative title that encapsulates the main focus of the report. It should give readers an idea of what to expect from the content.

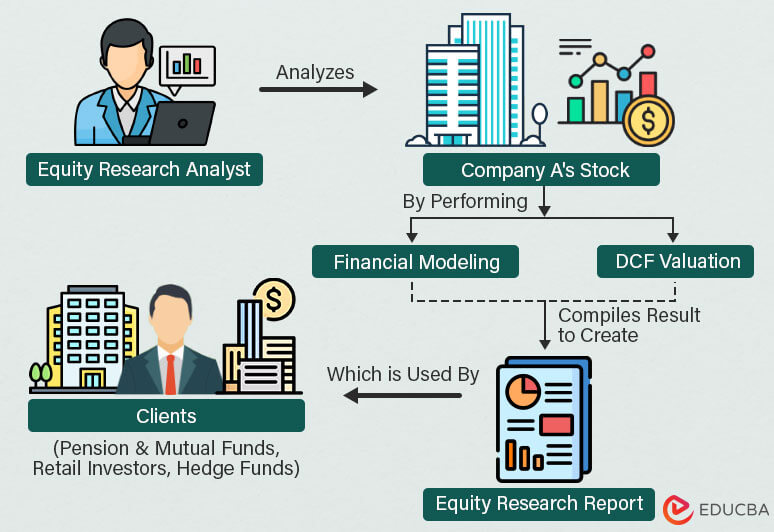

4. Target Price and Recommendation

This section provides an estimate of the stock’s future value, often referred to as the “target price.” Alongside this, the analyst typically includes a recommendation on whether to buy, hold, or sell the stock.

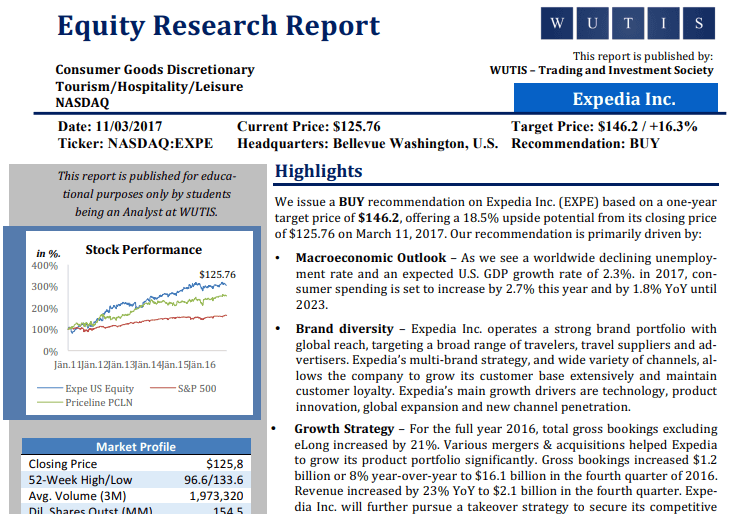

5. Stock vs. Index Graph

A graphical representation that compares the performance of the company’s stock to a relevant market index, such as the S&P 500 or an industry-specific index. This helps investors gauge how the stock has performed relative to the broader market.

6. Stock Data

This section provides detailed data about the company’s stock performance. It may include historical price charts, trading volume, price-to-earnings (P/E) ratios, earnings per share (EPS), dividend yield, and other relevant financial metrics.

7. Financial Analysis

A detailed examination of the company’s financial statements, including income statements, balance sheets, and cash flow statements. The analysis may cover metrics such as revenue growth, profit margins, debt levels, and liquidity.

8. Valuation Methodology

Explanation of the methods used to arrive at the target price, which may include discounted cash flow (DCF) analysis, comparable company analysis (comps), and precedent transactions analysis.

9. Investment Report Summary

A concise overview of the key points covered in the report. It highlights the company’s strengths, weaknesses, opportunities, threats (SWOT analysis), recent developments, and the rationale behind the target price and recommendation.

Follow the below steps to write equity research report accurately. For a downloadable equity research report template of Tesla Inc., check our article – Equity Research.

1. Gather complete information about the company.

You need to have a clear view of the company regarding Investment rationale, risk assessment, key growth drivers, cost drivers, and revenue drivers. You can collect the required information from the company’s official site or any financial tools like Yahoo Finance, Forbes, or Reuters.

2. Create a financial model and perform valuation analysis.

Use all the collected information to make a financial model for the company to project its performance for the next 2-3 years. After creating a financial model, perform an extensive valuation analysis using any valuation method, like DCF, relative valuation, etc.

3. Mention the company name and current target price.

State the company’s name at the top of the research report and the stock’s calculated target price after that.

4. Write an executive summary and add your recommendation/rating.

Add a quick summary about the company, mentioning its position in the industry, and after that, properly mention the recommendation or rating. Ratings in the equity research report fall into these categories:

5. Record a detailed overview of the company and its market.

Write about the company’s history, products, strategies, current market situation, as well as the market or industry’s current conditions and trends. Also include information about the financials, management, future plans of the company, growth estimates, etc. It should be a detailed description of the company and the market it is based in.

6. Add share price chart and other stock-related data.

Include the stock’s price chart showing its last 1 year’s price movements. You must also add these important segments:

7. Provide valuation analysis details and results.

Provide an in-depth explanation of how you performed your valuation analysis, including the valuation methods you used and the final valuation result.

8. Provide information about the risks.

You will also have to clearly state potential risks associated with the company’s stock, your analysis, and your recommendation.

9. Mention your interpretation of the recommendation.

While providing recommendations, you must have strong reasons to support them. Thus, mention appropriate reasons for your recommendations and write about why you think the share price will go up or down. Here are a few factors you can mention:

10. Present a quick summary and cite the sources.

At the end of your report, write a crisp and clear conclusion for your report and properly cite all the sources you used for your research.

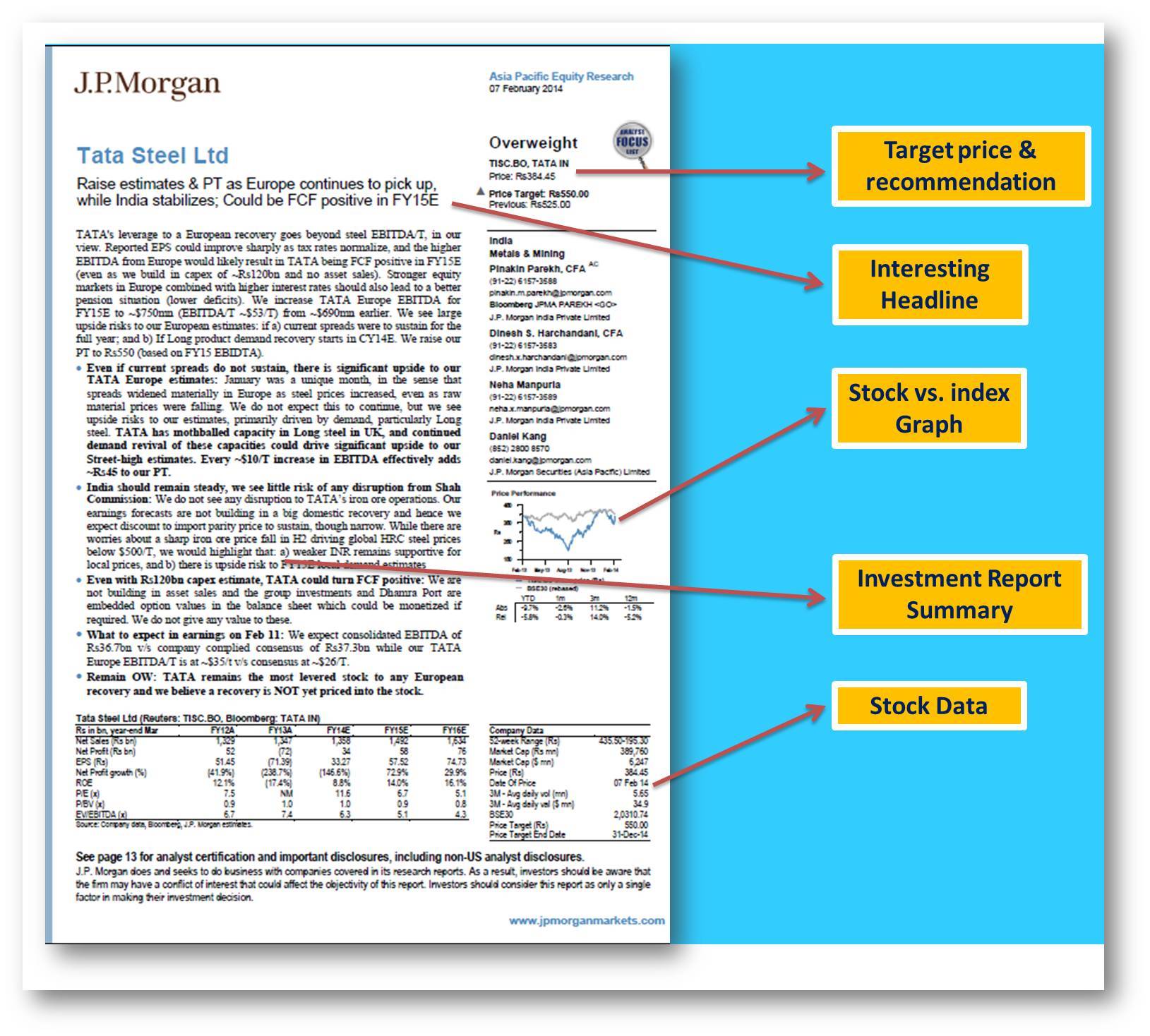

The main types of equity research reports are:

When an analyst covers a company for the first time, they write an initiation report. As it is the first report on the company, it is a comprehensive report containing information about the overview of the company, its stock, industry, competitive landscape, future prospects, and more.

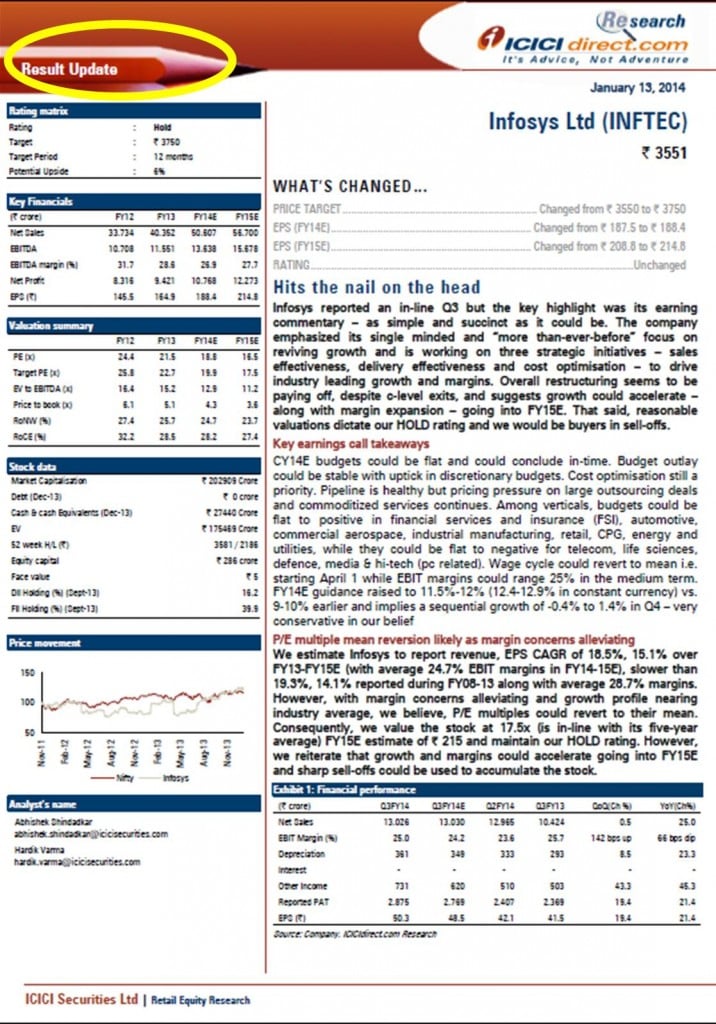

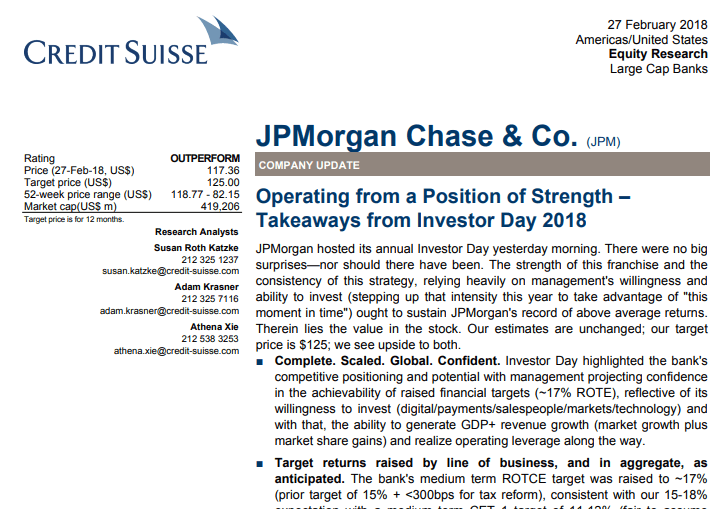

This report is also known as a company update, result update, or company note. It comprehensively analyzes a specific company, including its financial performance, history, valuation, growth prospects, risks, etc. Companies release these on a regular basis, often quarterly or semi-annually.

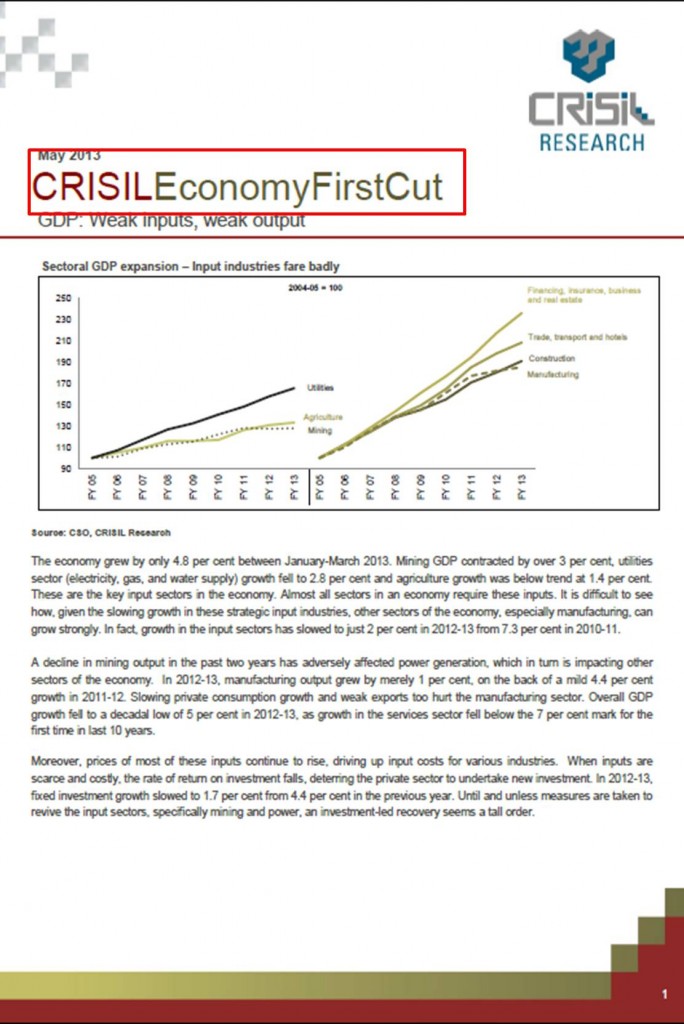

These reports provide analysis and insights into specific industries or sectors. They discuss industry overview, trends, challenges, growth prospects, key players, etc. These are especially useful for investors and analysts to assess the opportunities and risks associated with investing in companies within that industry or sector.

Flash reports provide quick insights into breaking news or development, like earnings announcements, regulatory updates, mergers and acquisitions, CEO resignations, etc. They are concise and include a brief event summary, initial reactions, stock valuation, and other impacts. These reports are essential for traders and investors who must make quick decisions based on breaking news.

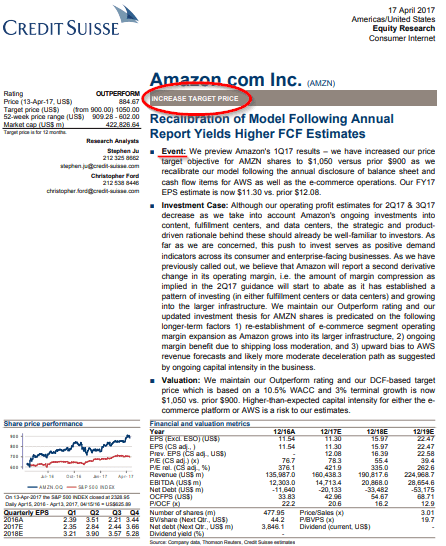

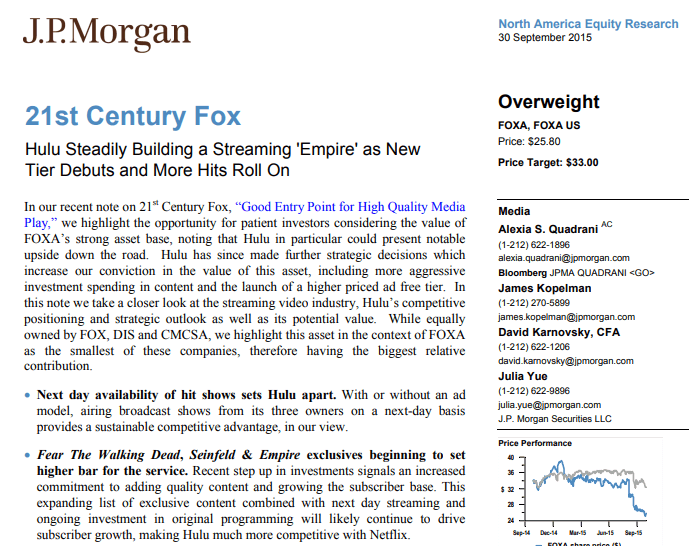

Every company might follow a slightly different format or template to write equity research report. Here are a few examples of real company equity reports.

(Source: Amazon AWS)

(Source: Credit Suisse)

(Source: Seeking Alpha)

Equity research reports are important for various reasons:

Answer: Equity research report writing is crucial for financial analysts and investors as it provides in-depth insights into companies’ financial performance and prospects. EDUCBA’s Equity Research Analyst Certification Course Bundle offers comprehensive training in equity research, financial analysis, and report writing. It covers topics like financial modeling, valuation techniques, industry analysis, and report creation, enhancing your skills for a successful career in finance.

Answer: All the possible lists of investors given below are the clients for such equity research reports.

Answer: Financial institutions, investment banks, and research firms often generate equity research reports. You can access them through these organizations’ websites, subscription-based financial databases, and financial news platforms. Here are a few sources you can refer to for equity research reports:

Answer: Equity research analysts and teams within financial institutions typically create equity reports. These professionals conduct thorough research on companies and industries to compile their findings into comprehensive reports offering recommendations. The two types of financial institutions that write equity research report are:

This article on how to write equity research report presents a detailed explanation of what equity reports are, their format, writing process, tips, and templates. For more information, refer to the following articles,

Excel Mastery for Data Analysis and Business Intelligence - Specialization | 24 Course Series | 10 Mock Tests

6133+ Hours of HD Videos

40+ Learning Paths

750+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

4.9

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates

4655+ Hours of HD Videos

80+ Learning Paths

470+ Courses

50+ Projects

Verifiable Certificate of Completion

Lifetime Access

4.7

all.in.one: FINANCE - 750+ Courses | 6133+ Hrs | 40+ Specializations | Tests | Certificates 6133+ Hours of HD Videos | 40+ Learning Paths | 750+ Courses | 40+ Projects | Verifiable Certificate of Completion | Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates 4655+ Hours of HD Videos | 80+ Learning Paths | 470+ Courses | 50+ Projects | Verifiable Certificate of Completion | Lifetime Access